January 2026

Energy

Nigeria

Heirs Energies acquired a 20.07% stake in Seplat for $496 million, becoming its largest shareholder, with founder Tony Elumelu joining Seplat’s board as a non-executive director.

What this means…

Beyond OML 17, the stake in Seplat gives Heirs Energies access to a broader and more diversified portfolio. By leveraging Seplat’s mixed assets (oil and gas, onshore and shallow water, as well as gas-to-power) exposure.

For Nigeria, the deal reinforces the long-standing push for increased indigenous participation in the oil and gas sector. It reflects a continuing trend of local companies taking over assets and influence previously held by international oil companies.

Source: Tony Elumelu now non-executive director on Seplat’s board

Ghana

Ghana has cleared $1.47bn in energy-sector debts, restoring the World Bank’s $500m guarantee and easing pressure on power supply.

Our thoughts…

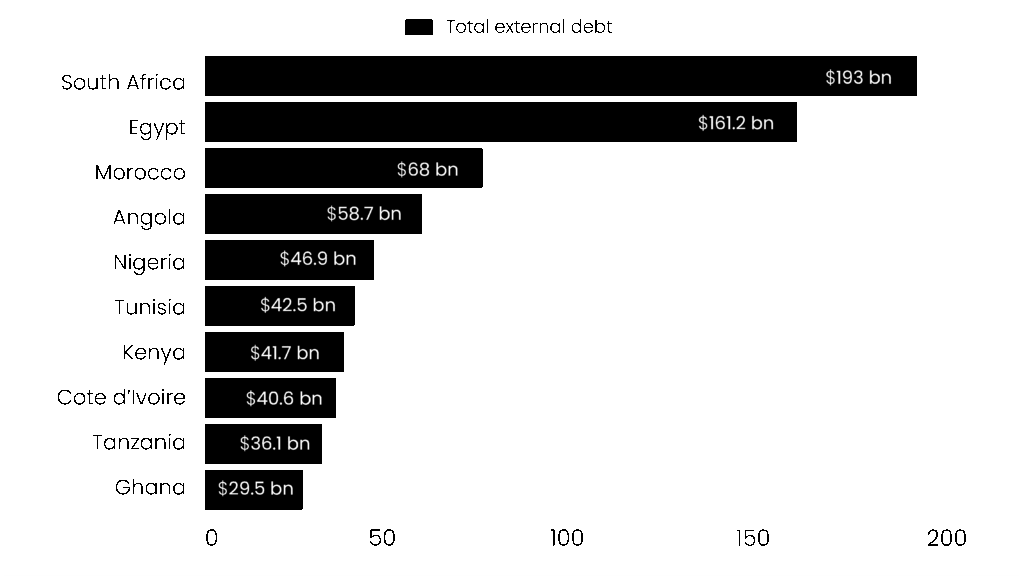

As of January 12, 2025, Ghana’s energy sector debt had risen to over $3 billion, which is about 10.2% of the country’s external debt, up from $2.1 billion in August 2017, an increase of approximately 43%. These mounting obligations have weighed heavily on the power sector, contributing to recurring electricity outages, disruptions in fuel supply, delayed plant maintenance, and a steady erosion of investor confidence.

Considering these developments, the current government’s decision to begin clearing these debts represents an important step in the right direction. Settling arrears helps stabilize electricity generation, restores confidence among power producers and gas suppliers, and improves Ghana’s credibility with international investors and lenders. However, debt clearance alone is not a permanent solution.

In essence, clearing the debt buys Ghana time. Long-term stability will depend on whether underlying structural weaknesses in the energy sector like the take-or-pay contracts, the outdated infrastructure and even delayed maintenance are addressed to prevent a repeat of the same debt cycle.

Source: Ghana pays $1.47 billion debts

Fig 1: African Countries with the Largest External Debt, 2025

Source: Moneda Intelligence

Malawi

Malawi now ranks second globally for fuel prices after a fresh 41% hike pushed petrol to $2.90 and diesel to $2.87, the second increase in four months.

What this means…

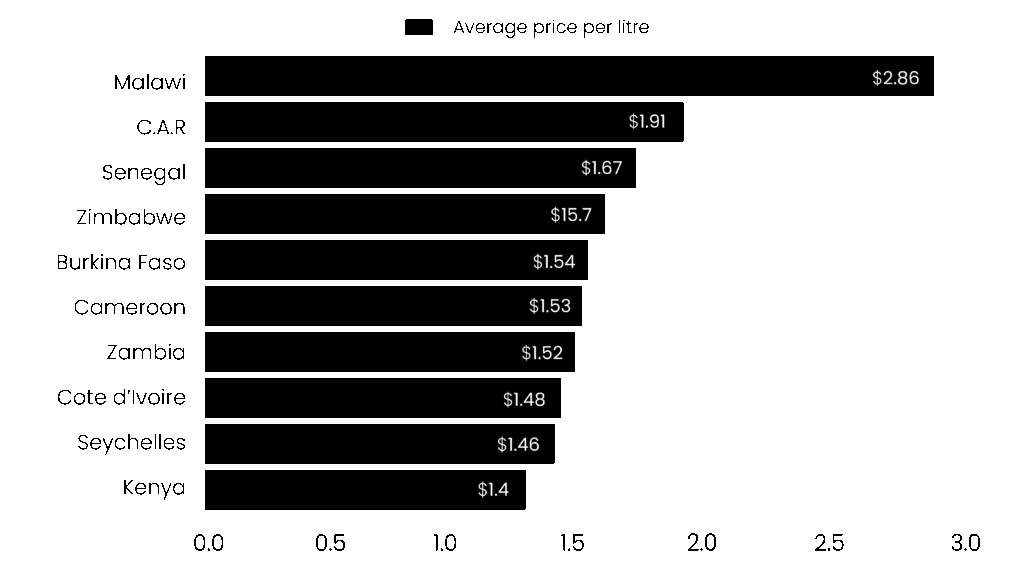

As a landlocked, non-oil-producing country, Malawi now has one of Africa’s highest fuel prices and the second-highest globally at about $2.86 per litre. While this will immediately raise transport costs, food prices, and inflation, deepening pressure on households, it reflects deeper structural challenges.

For years, Malawi’s fixed fuel pricing kept pump prices artificially low, leading to persistent fuel shortages, power cuts, rising public debt, and fuel smuggling to neighbouring countries. Import costs consistently exceeded regulated prices, forcing the government to absorb heavy losses.

By shifting back to an automatic pricing mechanism that tracks real import costs, the government aims to restore supply stability, curb smuggling, and reduce fiscal strain. Though painful in the short term, the move could improve energy security and free up resources for infrastructure and sustainable energy investment over time.

Source: Malawi 40% fuel price increase

Fig 2: Countries with the Most Expensive Fuel Prices in Africa, January 2026

Source: globalpetrolprices.com

Agriculture

South Africa

Farmers in Mpumalanga and Limpopo have reported widespread disruptions to farming activities and mounting financial pressure following prolonged rainfall that triggered severe flooding, which has now been declared a national disaster.

What this means…

South Africa is the world’s second-largest exporter of fresh citrus, with citrus exports alone rising 22% in 2025. Limpopo, which accounts for about 40% of total citrus production, sits at the heart of this export engine. However, severe flooding across Limpopo and Mpumalanga now threatens upcoming harvests, raising the risk of higher food prices, reduced export volumes, and tighter global supply.

The damage is already substantial: crops worth millions of dollars have been lost, and agricultural infrastructure valued at roughly $237 million has been destroyed. Mpumalanga’s agriculture department estimates that over R165 million ($10 million) in emergency support is needed to help affected farmers recover.

Beyond immediate relief, the floods highlight a deeper challenge. As extreme weather becomes more frequent, South Africa must invest in stronger flood control, climate-resilient farming systems, and early-warning infrastructure to protect agricultural output and preserve its export competitiveness.

Source: Flood affects citrus farmers in South Africa

Ivory Coast

The Ivorian government has stepped in to purchase unsold cocoa stocks held by local cooperatives, aiming to protect farmers’ incomes as prices fall to their lowest level in two years.

What is happening?

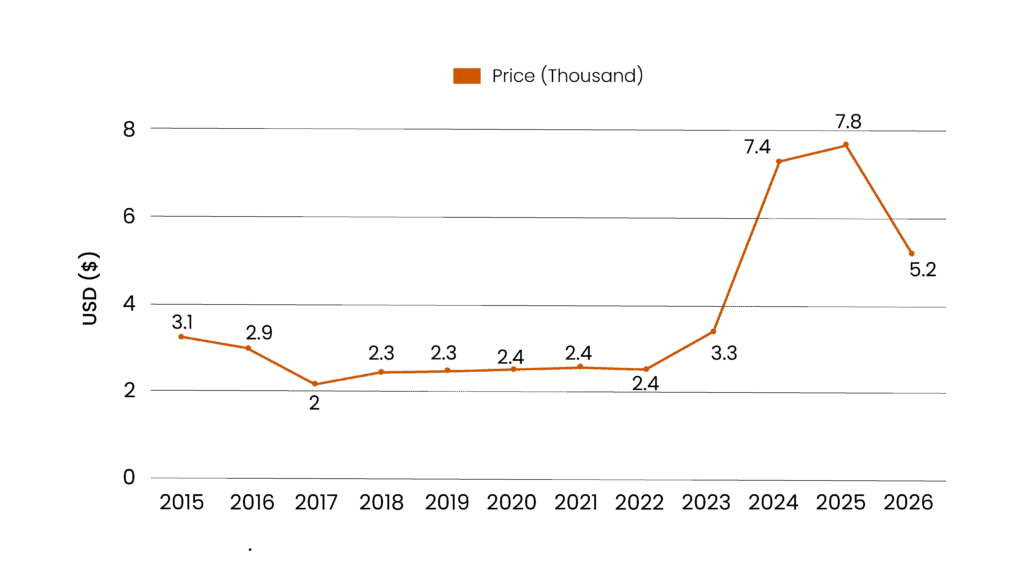

Ivory Coast, the world’s largest cocoa producer, relies heavily on the crop, which accounts for about 14% of GDP. But after a historic price surge in 2024, when cocoa averaged over $7,000 per ton due to El Niño-driven supply shocks and crop disease, global prices have now fallen to their lowest level in two years as consumers cut back on chocolate consumption.

To cushion farmers from the downturn, the government, through the Coffee and Cocoa Council (CCC), plans to purchase about 100,000 tons of surplus cocoa at the official farmgate price of 2,800 CFA francs/kg ($4,630 per ton). The CCC tightly regulates cocoa marketing, guaranteeing farmers a minimum price and helping stabilise incomes amid volatile global markets.

Authorities are also tightening border controls to prevent cocoa inflows from neighbouring countries, especially Ghana, to reduce excess supply and limit further price pressure. Together, these steps aim to protect farmer incomes, limit losses, and prevent deeper economic strain across rural communities, although some farmers have already been forced to sell at steep discounts or absorb crop losses.

Source: Ivory Coast government to buy cocoa stockpile

Fig 3: Price of Cocoa, 2015-2025

Source: Source: FRED (Federal Reserve Economic Data)

*Only data for January 2026 is available

Mining & Construction

Uganda

Uganda’s gold exports overtook coffee as the country’s largest export and leading source of foreign exchange in 2025, after shipments surged by 75.8% year-on-year.

Why this development?

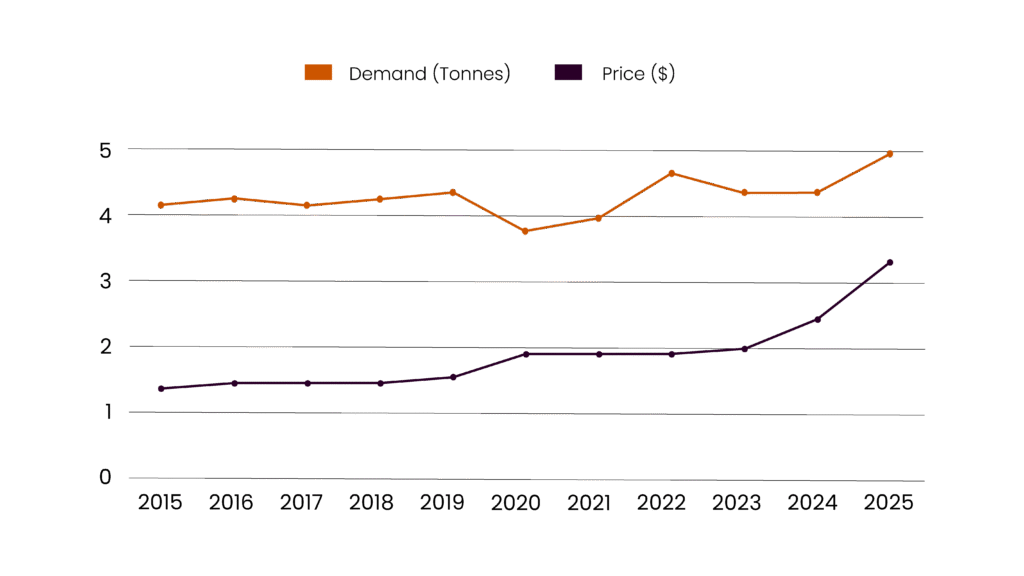

Coffee has long been Uganda’s signature export, and the country is widely recognized as Africa’s leading coffee exporter. There is really no problem with production either, in fact, 2025 was a record year. Exports in the year ending October hit an all-time high of 8.4 million 60-kg bags, valued at about $2.4 billion, up sharply from 5.8 million bags the year before.

So why did gold overtake coffee?

The short answer: timing and opportunity.

Global demand for gold surged in 2025 as investors looked for safe-haven assets amid economic and geopolitical uncertainty, pushing prices up by about 64% over the year. This price rally came at a good time, as Uganda inaugurated its first large-scale gold mine in August 2025 a $250 million Chinese-owned project in eastern Uganda, capable of refining gold to 99.9% purity.

This combination of rising global prices and new domestic capacity paid off quickly. Uganda’s gold exports jumped to $5.8 billion in 2025, up from $3.3 billion in 2024. Beyond its own production, the country has also positioned itself as a regional processing and trading hub, refining gold shipped in from neighboring countries like eastern Democratic Republic of Congo and South Sudan, even though Uganda itself produces relatively modest quantities of gold.

The government says the revenue from gold exports will be channelled into major infrastructure projects, including power generation and railway development, particularly the $3.16 billion standard gauge railway now under construction. If well managed, these inflows could significantly speed up Uganda’s development plans.

Overall, this shift is a strong reminder of why economic diversification matters. Uganda’s experience shows how countries can benefit from staying flexible, spotting new opportunities, and not relying too heavily on just one commodity, especially in a world where market conditions can change very quickly.

Source: Uganda’s gold export more than coffee

Fig 4: Price and demand of gold, 2015-2025

Source: World Gold Council

Botswana

Botswana’s diamond stockpile has climbed to nearly twice its target level, reaching a critical threshold.

What is happening?

Botswana, the world’s second-largest diamond producer after Russia, is now sitting on a growing stockpile of about 12 million carats, a situation that has become a major topic of concern. This buildup is largely the result of persistently low diamond prices, driven by rising competition from lab-grown gems, which are significantly cheaper, often costing between 40% and 90% less than natural diamonds. As consumers increasingly opt for these alternatives, demand for natural diamonds has weakened, leaving producers with unsold inventory.

The price slump has already forced Debswana, which accounts for about 90% of Botswana’s diamond sales, to temporarily suspend production at some of its mines. While Russia is also holding large diamond stockpiles, Botswana’s situation is far more delicate. Diamonds contribute roughly one-third of the country’s national revenue and about three-quarters of its foreign exchange earnings, making the economy highly sensitive to shifts in the sector. As a result, the buildup of unsold diamonds has contributed to a sharp 50% drop in sales, a 3% contraction in economic growth, and a widening budget deficit of around 9%.

In contrast, Russia’s more diversified economy allows it to absorb such shocks more easily, highlighting just how exposed Botswana remains to fluctuations in the global diamond market.

Leave a Reply