December, 2021

The performance and strategic directions of major international oil companies (IOCs) in Nigeria reveal a mixture of exit strategies, long-term investment plans, and asset divestments. The analysis provides insights into Chevron, ExxonMobil, Shell, TotalEnergies, and Eni’s distinct approaches within Nigeria’s oil and gas industry.

Chevron has signaled a gradual exit strategy marked by declining production costs and reduced capital expenditure (CAPEX) relative to its competitors. This aligns with observations of Chevron’s focus on short-term projects and existing operations, such as the Agbami field and Escravos GTL plant, which have been operational for over a decade. Chevron’s declining global output from Nigeria, decreasing from 8% in 2016 to 6% by 2020, further illustrates its reduced long-term investment commitment,

ExxonMobil‘s operations also reflect a strategic shift away from Nigeria, marked by its failure to exceed its peak production of 13 MMSCFD in 2018, and minimal presence in the country’s gas sector. The sale of shallow offshore assets to Seplat and limited progress on major projects like Bosi and Owowo underscore ExxonMobil’s decreased interest and declining CAPEX.

Shell‘s approach balances divestment and commitment. Security challenges have led Shell to divest onshore assets, including OML 17, sold to Heirs Holdings, while also exploring the sale of OML 21. However, Shell maintains robust offshore production and is expanding gas reserves, signaling a long-term focus on offshore and gas projects. Notable projects such as Bonga SW-Aparo (OML 118), Etan & Zabazaba (OPL 245), and HI (OML 144) reflect Shell’s commitment to its Nigerian portfolio. Leading in CAPEX among IOCs, Shell’s strategic investments are likely to support its energy transition ambitions.

TotalEnergies has adopted a long-term growth strategy, as seen in its focus on projects like Egina, Akpo, and Ikike, which has driven a 39% production increase from 2016 to 2019, only briefly affected by the 2020 OPEC+ cuts. TotalEnergies’ gas production and reserves have been growing, positioning it as the leading gas producer in Nigeria by 2020. With investments in projects like the Obite gas plant, TotalEnergies appears committed to a long-term future in Nigeria.

Eni, meanwhile, has increased its focus on gas production, achieving a 31.59% growth in 2020 despite stagnant oil output. However, its oil reserves have experienced slight declines, and concerns over its acquisition of OPL 245 may delay the potential growth from the Etan & Zabazaba project. Eni’s CAPEX, which reaches nearly $1 billion annually, ranks second among IOCs, although relatively high costs signal some inefficiency. Nonetheless, Nigeria’s growing contribution to Eni’s global production portfolio indicates the company’s growing commitment to the region’s gas sector.

IOCs in Nigeria have shown varied responses to Nigeria’s evolving oil and gas sector, where energy transition pressures, security concerns, and market dynamics shape their approaches. Chevron and ExxonMobil appear to be gradually withdrawing, while Shell, TotalEnergies, and Eni maintain or grow their investments, each adapting to Nigeria’s complex and shifting energy landscape.

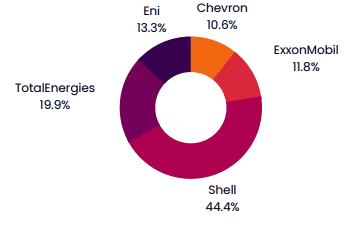

It has been speculated that a total of $8.345 billion will be spent by IOCs in 2022 – $5.033 billion in CAPEX and $3.312 billion in production cost. The CAPEX will be 15.7% higher than the average over the last 5 years and this is a result of the expected new projects. This increase in CAPEX does not spark much confidence in IOCs. The power is slowly shifting to the independents majorly as a result of IOC’s strategic withdrawal.

Fig 2: Percentage contribution to estimated CAPEX and production cost in 2022

Leave a Reply