Tag: Africa

-

Africa Has the Capital. The System Is the Problem

Across the continent, domestic institutional capital held by pension funds, insurance companies, sovereign wealth funds, and development banks exceed $1.1 trillion. According to the Africa Finance Corporation, this pool is expected to grow significantly over the coming decades. Pension funds alone manage roughly $455 billion. Yet only a very small share of this capital flows to small and medium-sized enterprises…

-

The African Perspective: Post-Harvest Losses

October 2025 Food loss is food removed from the supply chain after harvest but before retail, without being consumed or repurposed for productive uses such as animal feed, seed, or bioenergy. Food loss is categorized into Pre-harvest losses, which occurs on the farm, typically before harvest, and Post-harvest losses, which take place after harvest during…

-

Africa’s Gas Non-Investment

January 2025 Africa boasts 800 trillion cubic feet (tcf) of natural gas reserves, attracting $245 billion in planned investments for LNG terminals, gas pipelines, and power stations. However, many of these projects face significant challenges, including inefficiencies, lack of capital, policy gaps, insecurity, and more, putting their realization at risk. Fig. 1 – Gas Investments…

-

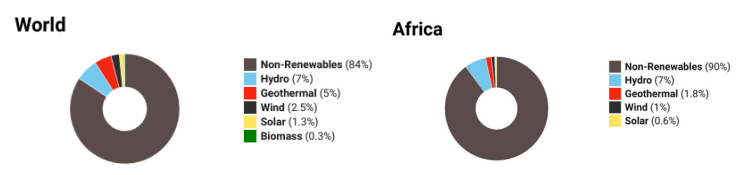

Africa’s Energy Transition

February, 2022 Africa’s energy generation currently sits at 1.79 Exajoule (EJ), with renewable energy contributing 0.16 EJ. The most developed source of renewable energy is hydropower which is exactly at the global average of 7%. It is, however, unlikely that it will continue this dominance in the next decade as the focus is shifting away…